[Ranking] Cyzone 2019 Top 50 Innovative Healthcare and Wellness Companies in China Unveiled—Growing and Innovating Against the Grain Amidst the Capital Winter

Release date:

2019-09-19

"The valuation bubble in the (healthcare and wellness) sector is gradually being squeezed out, as the market returns to rationality."

When asked about the biggest changes in China's healthcare and wellness venture capital landscape in recent years, several investors highlighted this point. They believe that after the investment and IPO boom in the healthcare and wellness industry from 2015 to 2017, the sector is now entering a major reshuffling phase. Both startups and investment firms will face intense competition—survival of the fittest—and the Matthew effect is set to intensify. Ultimately, only the leading companies and institutions will remain strong, continuing to thrive and grow even further.

This year, the financing data from the primary market serve as solid evidence. According to data from Cyzone Venture Capital Database, the domestic healthcare and wellness sector—identified as one of the key investment areas for VC/PE firms in the first half of 2019—experienced a total of 223 financing deals, raising RMB 32.949 billion in capital. Notably, this sector has consistently ranked among the top three most actively funded industries in China.

Although affected by the "capital winter," this data shows a significant decline compared to 295 financing deals and a total funding amount of 38.5 billion yuan during the same period last year. However, the average funding amount per project has increased, indicating that capital is increasingly concentrating in leading companies.

Yang Chao, a senior industry analyst at Huoshi Research Institute, also noted in an interview with Cyzone: "After a period of superficial chasing, capital is bound to become one of the key drivers behind advanced technologies. Currently, the industry has entered a new era of transformation and upgrading—where the era of universally accessible, high-growth sectors is firmly behind us. Exclusive market competition is about to unfold, and companies that genuinely excel in both technological and business model innovation are increasingly attracting the attention of investors."

Therefore, even though the challenge of raising capital for VC/PE firms has continued to ripple through to the project level since 2018, the healthcare and wellness sector—typically seen as a counter-cyclical industry—has managed to buck the trend and thrive amid the capital market downturn. With the Hong Kong Stock Exchange introducing new regulations aimed at facilitating financing for biotech companies seeking IPOs, coupled with the establishment of the STAR Market in China, the healthcare and wellness sector has delivered particularly strong IPO performance this year. As of August 30, 2019, 18 healthcare and wellness companies had already completed their IPOs, surpassing last year’s total of just 16 companies for the entire year.

In recent years, new technologies such as the internet, big data, and artificial intelligence have infused the healthcare and wellness industry with greater modern characteristics, continuously giving rise to new models, industries, and business formats. In 2019, Cyzone ranked the healthcare and wellness sector among its five most promising tracks. As a partner accompanying innovation and entrepreneurship, we are witnessing the healthcare industry enter a new phase of rapid growth and transformation.

This April, Cyzone proudly launched the "Top 50 Innovative Healthcare and Greater Health Companies in China 2019" selection event. After nearly five months of open applications, on-site visits, and rigorous judging by a panel of experts, 50 standout healthcare and greater health enterprises emerged as industry leaders and benchmarks for innovation this year. These companies span diverse sub-sectors, including biotechnology and pharmaceuticals, innovative medical devices, technology-driven healthcare solutions (such as internet-based platforms, big data, and AI), as well as healthcare services and pharmaceutical outsourcing—each excelling as a trailblazer in their respective fields.

Here is the list of 50 Top Innovative Healthcare and Wellness Companies in China for 2019, as selected by Cyzone.

Analysis of data from the 50 companies on the list:

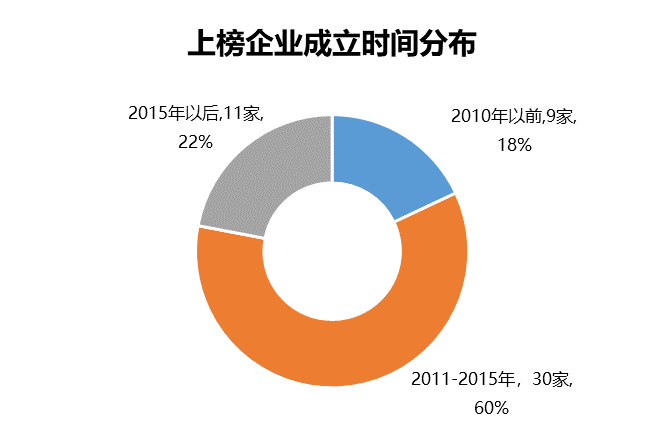

1. Distribution of Establishment Dates

The 50 companies on the list have an average establishment time of 5.24 years, with 30 firms founded between 2011 and 2015, accounting for 60% of the total. Eleven companies were established after 2015, representing 22%, while only 9 companies were founded before 2010.

After the implementation of the new healthcare reform in 2009, the entire market became remarkably vibrant. With the growing demand driven by an aging population, coupled with government policies in 2016 that encouraged the development of innovative pharmaceuticals, the greater healthcare industry has increasingly gained attention. As a result, numerous companies were established and flourished during this period. Today, China’s venture capital landscape for the healthcare sector is unprecedented—boasting both substantial financial investments and robust policy support.

Data source: Cyzone Research Center

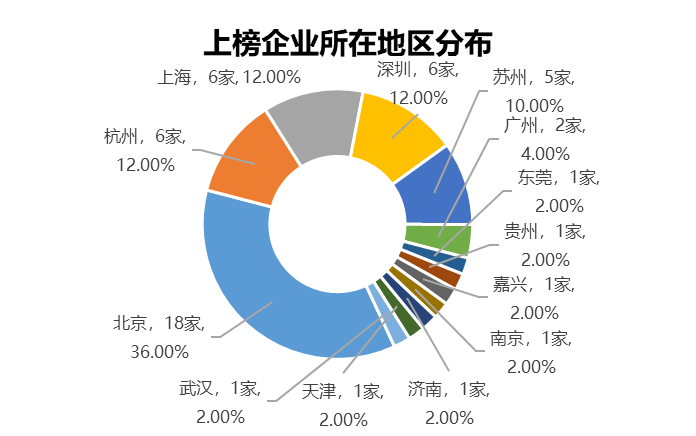

2. Regional Distribution

The 50 companies on the list are relatively concentrated in their geographic distribution, with the most headquartered in Beijing—18 companies in total—followed by Hangzhou, Shanghai, and Shenzhen, each with 6 companies. Additionally, Suzhou and Guangzhou have 5 and 2 listed companies, respectively.

As China's most developed first-tier cities, Beijing and Shanghai naturally enjoy significant advantages in terms of industrial resources, talent pools, and easy access to financing. Meanwhile, emerging as new first-tier cities on the national stage, the rising stars Hangzhou and Shenzhen have increasingly showcased their strengths in recent years—particularly in policy support, cutting-edge research, and a vibrant entrepreneurial ecosystem—drawing numerous top-tier healthcare and wellness companies to establish and thrive there.

Data source: Cyzone Research Center

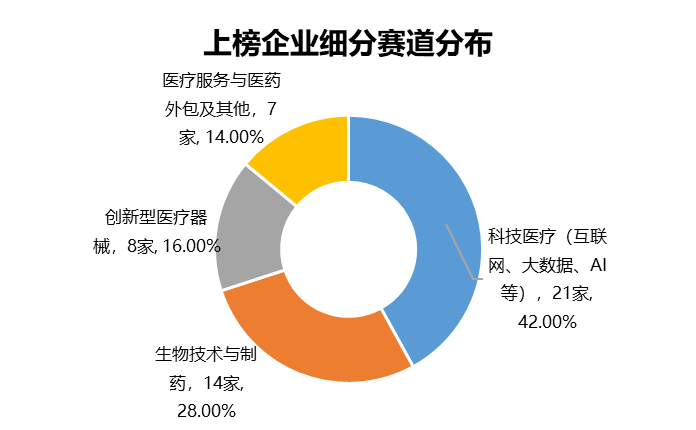

3. Segmented Track Distribution

The 50 companies on the list primarily come from the tech and healthcare sectors—specifically internet-based healthcare, healthcare big data, and AI-driven medical solutions—accounting for 42% of the total. Next are biotechnology and pharmaceutical companies, representing 28%, while innovative medical devices and healthcare services, along with pharmaceutical outsourcing and other enterprises, make up 16% and 14%, respectively.

Since April of last year, while implementing standardized management of medical technology, the government has also successively introduced multiple policies aimed at encouraging and promoting the healthy development of science and healthcare. Keywords such as "smart healthcare," "big data," "informatization," and "telemedicine" have frequently appeared in the National Health Commission's "Action Plan for Further Improving Medical Services (2018-2020)," which outlines key performance indicators for assessing progress in this area.

Founded in 2017, Shukun Technology reconstructs digital organs such as the "digital heart" and "digital brain" from medical imaging. Not only does this technology enable fully automated detection of "lesions" and identification of "medical history," but it also reduces the time required for diagnosing a single case—from over 30 minutes to just 5 minutes—significantly boosting both doctors' efficiency and diagnostic accuracy. In February of this year, Shukun Technology completed a new round of Series B funding totaling 200 million yuan.

In recent years, with the support of a series of national policies, the biotechnology and pharmaceutical sectors have gradually become more dynamic. According to financing trends in the healthcare and wellness industry during the first half of 2019, nearly half of the total funding was directed toward biotech and pharmaceutical companies—among which innovative drugs have emerged as the top priority, continuously attracting significant investment deals.

Among the companies featured this time, Nuofus stands out as China's first R&D firm focused on ophthalmic gene therapies. Targeting Leber's hereditary optic neuropathy (LHON) as its breakthrough area, Nuofus is leveraging gene therapy technology to bring hope and sight back to countless patients suffering from inherited eye diseases. To date, Nuofus has completed 159 clinical trials, demonstrating a 6-month efficacy rate of 62.99% and a 12-month efficacy rate of 63.21%.

In the innovative medical device sector, as economic standards rise, people are placing greater emphasis on risk prediction and early screening for diseases. Founded by Zou Hongzhi, an expert under China’s "Thousand Talents Plan," Kangliming Bio is a cutting-edge biotech company dedicated to developing high-tech products such as fecal DNA-based colorectal cancer screening kits. Its flagship product, "Changxinqin," significantly enhances the detection rate of colorectal cancer, effectively reducing its incidence while enabling early detection, prevention, and treatment—thus making a substantial contribution to public health.

Data source: Cyzone Research Center

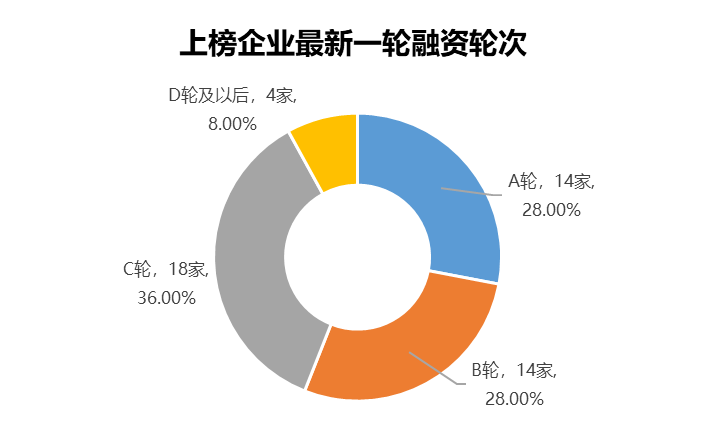

4. Distribution of Funding Rounds and Funding Amounts

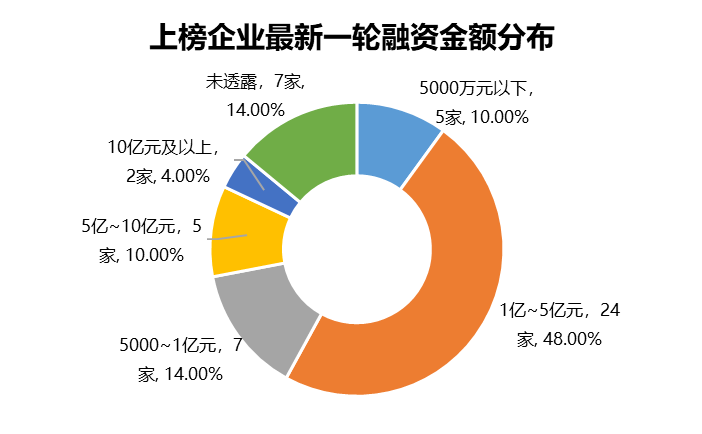

The 50 companies on the list have an average valuation of 1.983 billion yuan, with the latest funding rounds primarily concentrated in Series C, accounting for 36%, followed by Series A and Series B, each representing 28%. Notably, the largest share of the most recent funding rounds—48%—ranged from 100 million to 500 million yuan, while rounds raising less than 100 million yuan made up 24%, those between 100 million and 500 million yuan accounted for 10%, and funding rounds exceeding 1 billion yuan represented 4%.

Currently, China's population has reached a turning point. Over the next decade, the healthcare and wellness sector is poised for sustained growth, driven by technological innovation and import substitution that will fuel the rapid expansion of domestic healthcare and wellness companies. As the industry gains increasing favor from both markets and investors, there’s a growing trend of larger funding rounds for early- to mid-stage projects.

Data source: Cyzone Research Center

5. Founder’s Age and Overseas Background

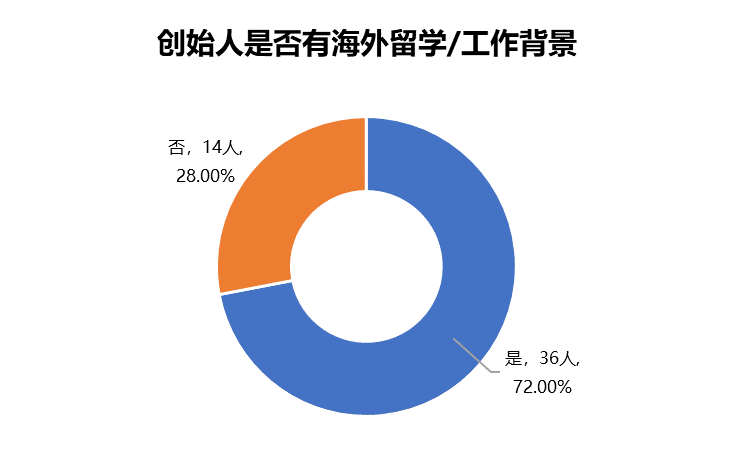

The average age of the founders of the 50 companies on the list is around 42, with the youngest founder being just 30 years old. Notably, 36 of the founders have overseas study or work experience, accounting for 72% of the group.

The 50 companies have an average workforce of 365 employees, with each enterprise holding an average of 13 authorized invention patents and employing an average of 95 R&D personnel. (Statistics as of June 30, 2019)

Data source: Cyzone Research Center

Thanks to the vast market potential in China's healthcare and wellness sector, coupled with the continuous improvement of China's pharmaceutical policies and the rising sophistication of medical consumption over the past two years, a growing number of industry professionals who previously studied or worked overseas have returned to China to start their own businesses—driven by the nation’s "Thousand Talents Plan." However, compared to developed countries like Europe and the U.S., China's healthcare and wellness companies still lag behind in terms of independent R&D capabilities. Their innovative strength remains to be strengthened, and they still need to accumulate more experience in industrialization. To truly catch up with and surpass these global leaders, China will require even greater contributions from returning talent and individuals with a truly international perspective.