A smart diabetes drug—will the DPP-4 inhibitor senglutide eventually surpass its competitors?

Release date:

2023-03-09

Since Shengshi Taikang’s independently developed innovative Class 1 drug, Shengetin, received acceptance of its marketing application by the National Medical Products Administration, it has drawn significant attention from the industry. Recently, the well-known industry publication *Beike She* seized this opportunity to provide a comprehensive overview of the booming domestic DPP-4 inhibitor market—and its vast growth potential—sharing this insightful article with everyone. Amidst the high expectations placed on the company by the industry, Shengshi Taikang remains committed to completing the final "mile" toward product launch with a scientific and meticulous approach.

Diabetes mellitus (DM), as a chronic condition, has garnered significant attention. Diabetes medications have become the second-largest pharmaceutical market, trailing only oncology drugs—and are now fiercely contested territory for pharmaceutical companies.

With the advancement of medicine, several new drugs have emerged in recent years, each with a mechanism of action distinct from traditional oral antidiabetic medications. Among these is the dipeptidyl peptidase-4 (DPP-4) inhibitor—a class now comprising dozens of commercially available DPP-4 inhibitors, collectively known as "gliptin drugs." Looking ahead, the market for gliptin drugs in China is expected to surpass 30 billion yuan.

Sheng Gliflozin: A Seven-Year Marathon

On February 2, Shengshi Taikang’s New Drug Application (NDA) for the DPP-4 inhibitor senglitin was accepted by the National Medical Products Administration (NMPA), primarily intended for the treatment of type 2 diabetes. This marks the arrival of a new player in China’s DPP-4 inhibitor market. Meanwhile, Shengshi Taikang promptly updated its product pipeline on the company’s official website to reflect the ongoing development progress of senglitin, confirming that its market launch is now virtually assured.

Pipeline Progress

Source: Shengshi Taikang Official Website

Shenggleditin is a Class 1 innovative drug independently developed by Shengshitaike, once serving as the company's flagship product in its pipeline. Since its inception seven years ago, the drug has been on an ambitious seven-year journey—and now, it’s poised to cross the finish line successfully.

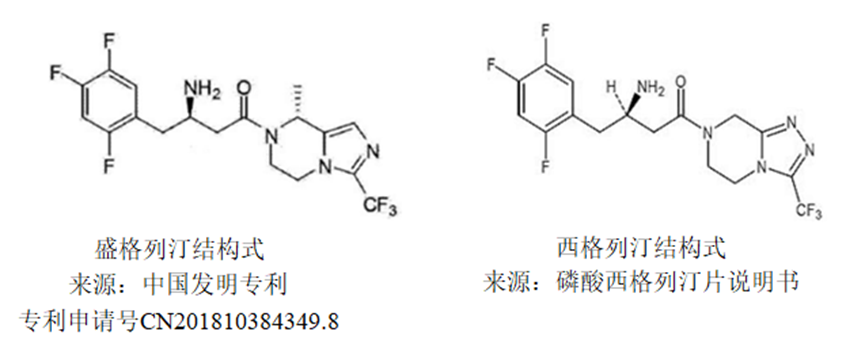

In 2006, the targeted antidiabetic drug sitagliptin received FDA approval in the U.S., marking a landmark event for the industry. Ten years later, Shengshi Taikang completed preclinical studies comparing shenglitatin head-to-head with sitagliptin.

In early 2018, Shengshi Taikang initiated a Phase I clinical trial comparing senglitin with sitagliptin head-to-head. Among nearly 200 patients who completed the Phase I trial for senglitin, data showed that senglitin at a dose of 50 mg already demonstrated DPP-4 inhibitory activity equivalent to that achieved by 100 mg of sitagliptin. Senglitin is administered once daily, reaching peak levels within 1 to 2 hours after dosing, and boasts a longer half-life compared to sitagliptin, enabling more sustained maintenance of stable blood sugar control over time.

Diabetes requires long-term medication, and safety is the primary factor doctors consider when selecting a drug for prescription. In safety studies, nearly no adverse effects of sengliflozin on patients were detected—levels were even lower than those observed in the placebo and sitagliptin groups. Moreover, despite sengliflozin’s long half-life, Phase I clinical trials revealed no evidence of drug accumulation or residue buildup in the body, highlighting its high selectivity and potent inhibitory activity. These compelling Phase I clinical trial results provide strong confidence for advancing sengliflozin into later-stage clinical research.

In 2019, Senglitin received formal approval from the National Medical Products Administration's Center for Drug Evaluation to "skip Phase II clinical trials and proceed directly to Phase III," making it the world's first DPP-4 inhibitor to bypass Phase II testing entirely—thanks to a quantitative pharmacology model—and move straight into a pivotal Phase III trial. This groundbreaking approach has drawn significant attention from diabetes experts both domestically and internationally.

In October 2022, the unblinding results of the Phase III clinical trial for senglitin revealed that the 50mg dose group achieved the primary clinical endpoint, demonstrating a significant reduction in HbA1c levels by Week 24—superior to the control group. Additionally, over the following 28 weeks, the 100mg dose group maintained excellent safety profiles, with an adverse event rate comparable to the placebo group. The trial also highlighted the advantage of senglitin, as it could be administered at half the standard dose while still delivering comparable efficacy to other similar products.

In February 2023, the New Drug Application (NDA) for senglatide was accepted by the NMPA for the treatment of type 2 diabetes.

The approval of senglitazone has drawn significant attention, signaling that Shengshi Taikang is officially entering the booming domestic market for DPP-4 inhibitors—meaning the multi-billion-dollar glitazone drug segment will soon welcome a new player.

The DPP-4 inhibitor market is booming.

DPP-4 inhibitors primarily lower blood sugar by inhibiting the DPP-4 enzyme from breaking down glucagon-like peptide-1 (GLP-1), thereby enhancing glucose-dependent insulin secretion and suppressing glucagon release. Additionally, these drugs help improve dysfunctional beta-cell function without increasing the risk of hypoglycemia or causing weight gain in patients. Moreover, DPP-4 inhibitors are a "gentle all-rounder"—they offer mild yet effective blood sugar control, are versatile, and highly safe, making them an ideal oral medication that can be safely combined with a wide range of other therapeutic agents throughout comprehensive diabetes management.

As the leading class of antidiabetic drugs today, DPP-4 inhibitors have become highly sought after by major pharmaceutical companies. Currently, there are five DPP-4 inhibitors available on the domestic market for daily use: sitagliptin, vildagliptin, saxagliptin, alogliptin, and linagliptin—and all five "golden flowers" have been included in the National Medical Insurance Catalogue.

After being included in medical insurance, several products experienced significant sales growth. It is reported that from 2016 to 2022, the annual sales of DPP-4 inhibitors showed a steady upward trend, with the highest year-on-year growth rate recorded in 2018. In 2021 alone, domestic sales of DPP-4 inhibitors reached nearly 7 billion yuan.

Sitagliptin

Sitagliptin is the world's first approved oral DPP-4 inhibitor, developed by Merck. It received FDA approval for marketing in October 2006, and was approved for launch in China in September 2009. In July 2012, its combination formulation was also approved for registration in China.

According to Merck's annual report, sitagliptin has maintained a global market share consistently above $3 billion over the past four years, firmly securing its position as the world's top-selling DPP-4 inhibitor. Currently, 14 pharmaceutical companies in China— including Zhengda Tianqing, Qilu Pharmaceutical, Kelun Pharmaceutical, and Zhejiang Medicine—have successfully developed generic versions of the drug and received approval for production.

Vildagliptin

Vildagliptin was developed by Novartis and became the world's second DPP-4 inhibitor to reach the market. In September 2007, vildagliptin first received approval from the European Commission for launch; in August 2011, it was officially approved for marketing in China.

According to Novartis' annual report, Vildagliptin's global sales have remained relatively stable over the past few years, consistently hovering around $1.1 billion. In the domestic market, generic production of Vildagliptin is also gaining significant momentum—currently, 18 pharmaceutical companies, including Qilu Pharmaceutical, Yangtze River Pharmaceutical, Jiangsu Hausen Pharmaceutical, Shandong Langno Pharmaceutical, and Nanjing Shenghe Pharmaceutical, have received approval to manufacture the drug, firmly establishing them as the leading players in China’s DPP-4 inhibitor generics market.

Saxagliptin

Saxagliptin was jointly developed by Bristol-Myers Squibb and AstraZeneca. It received FDA approval for marketing in July 2009, and in May 2011, saxagliptin was approved for launch in China. Today, saxagliptin holds an overseas market share exceeding 20%. Domestically, five pharmaceutical companies— including Zhengda Tianqing, Qilu Pharmaceutical, and Jiangsu Ousikang Pharmaceutical—have already been approved to produce generic versions of the drug.

Liglibenin

Lixisenatide was developed by BI. It received U.S. FDA approval for marketing in May 2011 and is jointly marketed by Boehringer Ingelheim and Eli Lilly. In March 2013, China approved the import registration of lixisenatide. Today, lixisenatide holds an overseas market share exceeding 15%. Domestically, six pharmaceutical companies—including Guangdong Dongyangguang Pharmaceutical, Yangtze River Pharmaceutical, and Kelun Pharmaceutical—have already been approved to produce generic versions of the drug.

Alogliptin

Alogliptin was developed by Takeda Pharmaceutical Company of Japan. It received approval for marketing in Japan in April 2010, was approved by the U.S. FDA in January 2013, and obtained China's import registration certificate in July of the same year. According to IQVIA data, alogliptin generated sales of 52.36 million yuan in the Chinese market in 2022. Currently, 11 pharmaceutical companies—including Yabao Pharmaceutical, Ruiyang Pharmaceutical, and Sinopharm Guorui Pharmaceutical—have been approved to produce the drug.

Looking at the domestic market for DPP-4 inhibitors, it’s dominated by the original and generic versions of these "five golden flowers." To shake up the competitive landscape, pharmaceutical companies are increasingly investing in their own innovative, in-house R&D teams.

Currently, the development of innovative DPP-4 inhibitors is also rapidly advancing. According to available data, in addition to Shenggetidegin, which was recently approved by Shengshitaike, several other innovative DPP-4 inhibitors (excluding combination formulations) in China have already entered the clinical research phase.

Zhengda Tianqing's TQ-F3083 from Nanjing Shunxin, Chenxin Pharmaceutical's saxagliptin, and Shandong Baijidi Changzhao Pharmaceutical's bocaglitazone are currently in Phase II clinical trials; while Xinlitaide's pradigliflozin, CSPC Pharmaceutical Group's DBPR108, Hansoh Pharma's HSK7653, and Yuandong Bio's uoglitazone have all advanced to Phase III clinical trials. Meanwhile, Hengrui Medicine's regliflozin has already submitted its marketing application.

Although there are currently very few domestically developed DPP-4 inhibitors approved for market in China—known as the "Ting" drugs—the approval of senglatide marks the first step in ushering in a harvest period for innovative DPP-4 inhibitor drugs made entirely in China. This breakthrough once again breaks the monopoly held by non-domestically developed DPP-4 inhibitors, giving pharmaceutical companies dedicated to DPP-4 inhibitor research and development a significant boost in confidence.

Conclusion

The vast market potential for diabetes acts like a magnet, drawing pharmaceutical companies into the fiercely competitive domestic race to develop DPP-4 inhibitors.

As the world's and China's first orally administered DPP-4 inhibitor to hit the market, sitagliptin has dominated the Chinese pharmaceutical landscape for over a decade—and continues to hold a commanding lead today. Meanwhile, according to Phase I clinical trial results, senglitin demonstrates significantly superior performance compared to sitagliptin in terms of efficacy, safety, half-life, toxicity, and pathology, making it highly compelling from a market perspective. This breakthrough could position senglitin as the "Best-in-class" product in its category, potentially enabling it to leapfrog competitors and reshape the competitive dynamics of the market altogether.

Shengglitine is just one step away from market launch—not only does Shengshi Taikang have high expectations for it, but the industry as a whole is also pinning great hopes on its success. With Shengglitine already showing promising potential, we eagerly anticipate the emergence of more domestically developed, groundbreaking "glitine" drugs in the future.

References:

1. Shengshi Taikе Official Website & WeChat Official Account

2. "A New Weapon in Diabetes Treatment (Part 1) — DPP-4 Inhibitors," Department of General Medicine, The University of Hong Kong-Shenzhen Hospital, December 9, 2020

3. "Unique Mechanism, Multidimensional Benefits — The Mechanism of DPP-4 Inhibitors and Their Clinical Applications," China Medical Forum Today: Endocrinology, April 9, 2020

4. "DPP-4 Inhibitor Market May See a New Player—Can Shengshitaike Break the 'Big Five' Dominance?" Yidu Medicine, February 3, 2023

5. "Market | Analyzing the DPP-4 Inhibitor Landscape After Dongyang Guang Withdraws Its First Generic Diabetes Drug from the Market," CPHI Pharma Online, November 17, 2022